Table of Contents

- Vanguard VOO ETF: S&P 500 Next 10-Year Annual Returns Likely 2-5% ...

- Here's Why You Should Buy Vanguard ETFs During the Market Meltdown ...

- VOO Stock Fund Price and Chart — AMEX:VOO — TradingView

- Voo Dividend 2025 - Alyson Laurel

- VOOG: Vanguard의 S&P 500 성장 ETF는 계속해서 빛나고 있습니다 : 네이버 포스트

- VOOとは?NISAでも買える?株価予想やVTIとの比較も紹介 | イーデス

- VOO letter logo design on white background. VOO creative circle letter ...

- Vanguard S&P 500 ETF: Here’s why VOO is better than SPY

- Vanguard S&P 500 ETF Trade Ideas — AMEX:VOO — TradingView

- VOO Stock Forecast - 2024, 2025, 2028, 2030, 2035

What is VOO ETF?

Benefits of Investing in VOO

Key Features of VOO

Some key features of VOO include: Index Tracking: VOO tracks the S&P 500 Index, which is widely considered to be a benchmark for the US stock market. Low Turnover: The fund has a low turnover rate, which means that it doesn't buy and sell stocks frequently, reducing trading costs. No Minimum Investment: There is no minimum investment requirement to invest in VOO, making it accessible to investors of all sizes. Tax Efficiency: VOO is designed to be tax-efficient, with a low turnover rate and a focus on long-term investing.

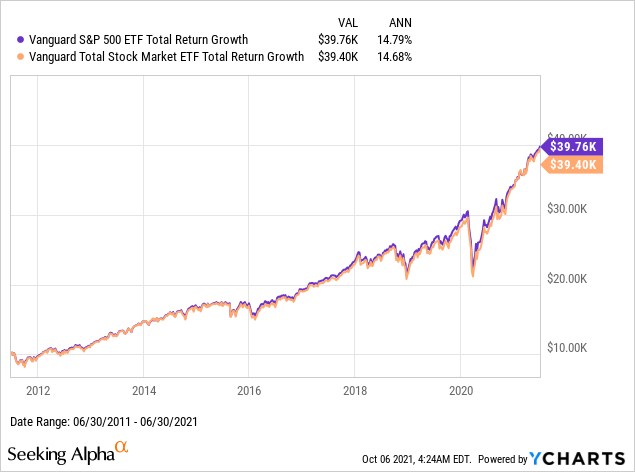

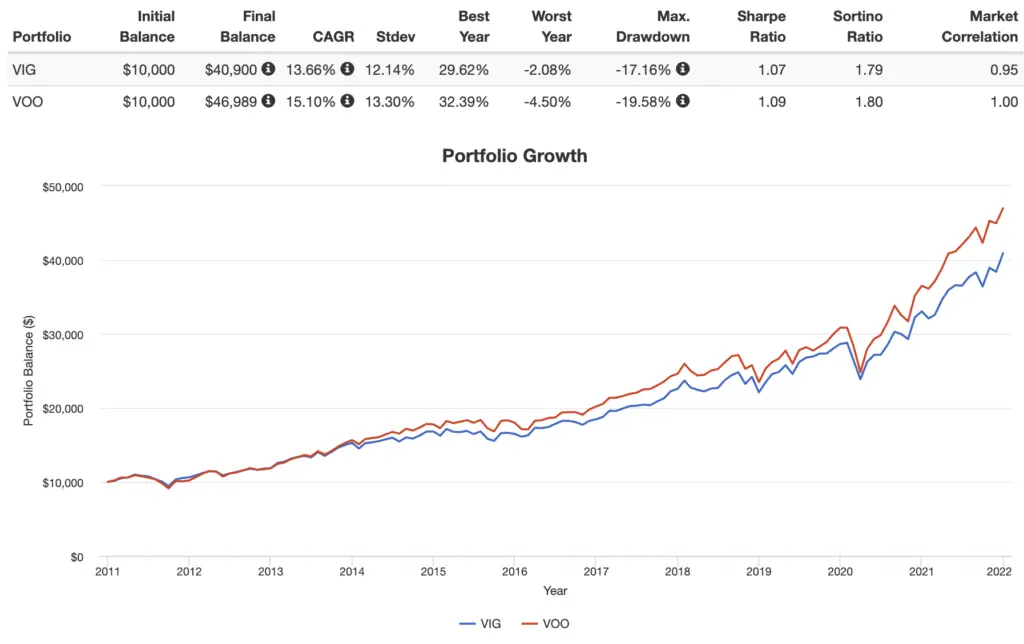

Performance of VOO

VOO has consistently delivered strong performance over the years, with a long-term track record of outperforming many actively managed funds. According to MarketWatch, VOO has a 1-year return of 13.65%, a 5-year return of 10.35%, and a 10-year return of 13.45%. In conclusion, VOO is a popular and widely traded ETF that provides investors with a diversified portfolio of 500 of the largest and most stable companies in the US stock market. With its low costs, flexibility, and transparency, VOO is an attractive option for investors looking to track the performance of the S&P 500 Index. Whether you're a seasoned investor or just starting out, VOO is definitely worth considering as part of your investment portfolio.For more information on VOO and other ETFs, visit MarketWatch for the latest news, data, and analysis.