Table of Contents

- 中国11月CPI按年升1.6% 创八个月新低_凤凰网视频_凤凰网

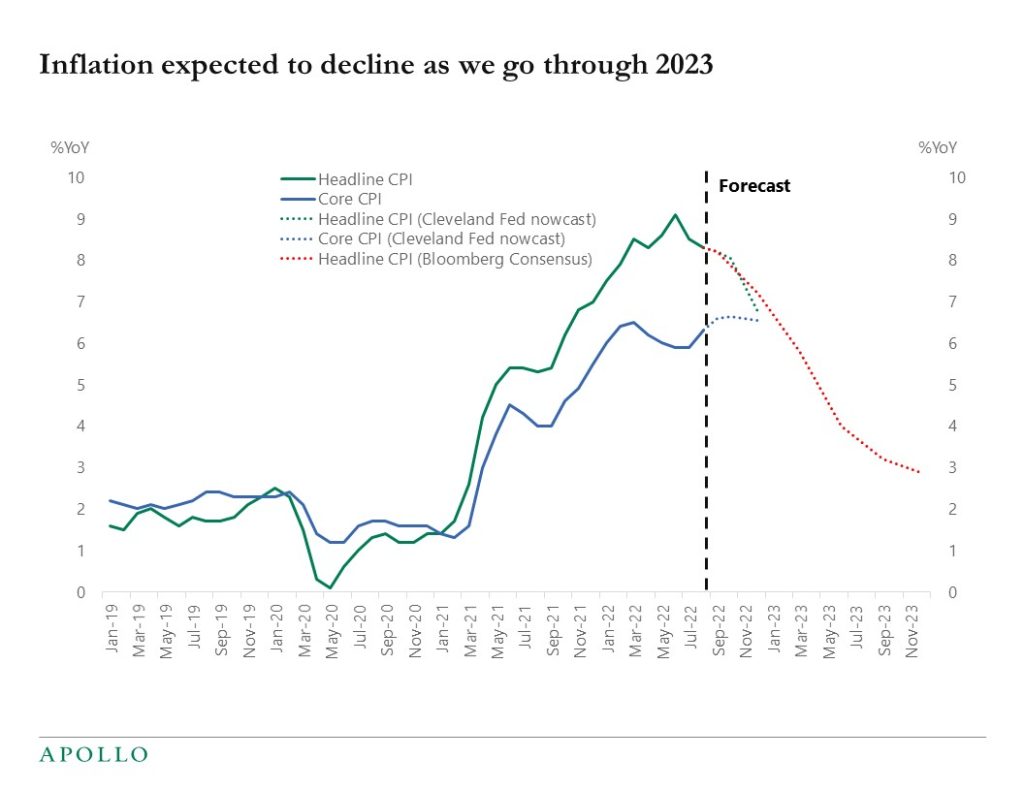

- CPI Data Tomorrow - Apollo Academy

- What’s in the Core of the CPI? – Political Arithmetick

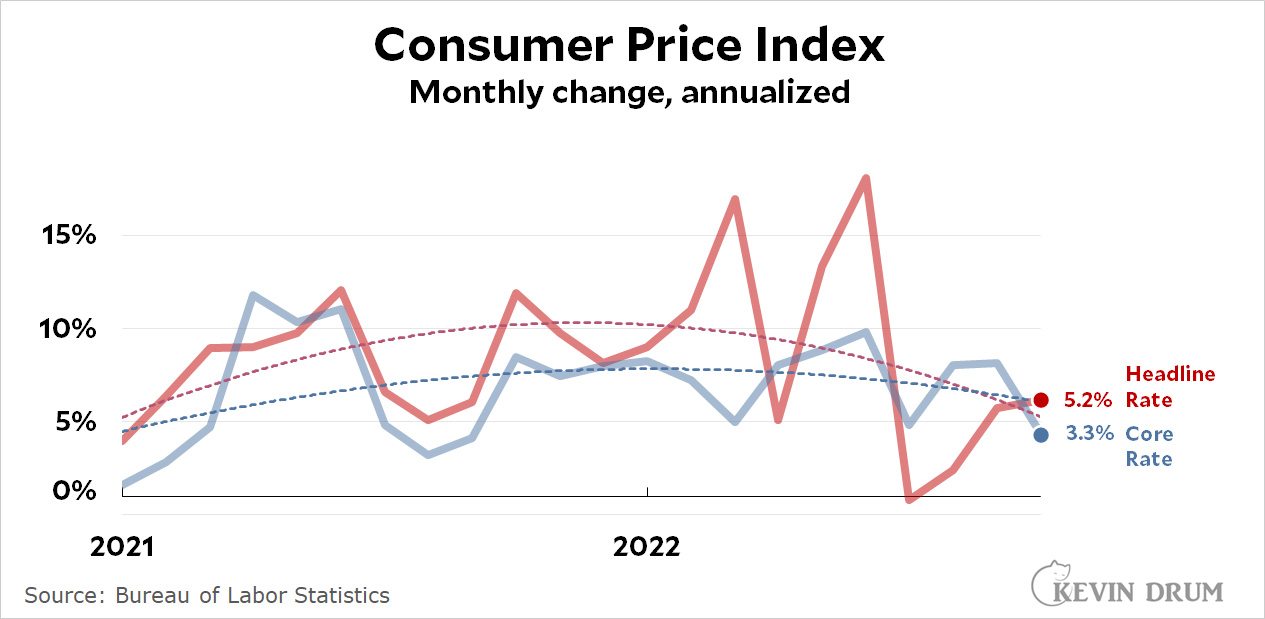

- Core CPI, the number to care about, plummeted this month – Kevin Drum

- INTERNATIONAL INSTITUTE OF IFORMATION TECHNOLOGY, (I²IT) - ppt download

- Headline Consumer Price Index inflation - Dallasfed.org

- Will Crypto Prices Pump If US CPI Data This Week Shows Inflation ...

- Krugman Section 3 Modules 10 and ppt download

- Chỉ số CPI là gì? Sự ảnh hưởng đối với thị trường Crypto | Cập nhật tin ...

- Consumer Price Index or CPI compare with Personal Consumption ...

What is the Consumer Price Index (CPI)?

.jpg)

How is the CPI Calculated?

What is the CPI YoY Growth Rate?

The CPI YoY growth rate measures the percentage change in the CPI over the past 12 months. It is calculated by comparing the current month's CPI with the same month's CPI from the previous year. The CPI YoY growth rate is a key indicator of inflation, which is a sustained increase in the general price level of goods and services in an economy.

Why is the CPI YoY Important for Investors?

The CPI YoY growth rate is essential for investors because it helps them understand the inflationary environment and make informed investment decisions. A high CPI YoY growth rate may indicate that inflation is rising, which can lead to higher interest rates, reduced consumer spending, and decreased economic growth. On the other hand, a low CPI YoY growth rate may indicate that inflation is under control, which can lead to lower interest rates, increased consumer spending, and higher economic growth..jpg)

Implications for Investors

The CPI YoY growth rate has significant implications for investors. A rising CPI YoY growth rate may lead to: Higher interest rates, which can increase borrowing costs and reduce consumer spending Reduced demand for bonds, which can lead to higher yields and lower bond prices Increased demand for stocks, particularly those in sectors that are less affected by inflation, such as technology and healthcare Higher commodity prices, which can benefit investors in commodity-related assets, such as gold and oil On the other hand, a low CPI YoY growth rate may lead to: Lower interest rates, which can reduce borrowing costs and increase consumer spending Increased demand for bonds, which can lead to lower yields and higher bond prices Reduced demand for stocks, particularly those in sectors that are more affected by inflation, such as consumer staples and real estate Lower commodity prices, which can hurt investors in commodity-related assets The United States Consumer Price Index (CPI) YoY growth rate is a critical indicator for investors, policymakers, and economists. It provides valuable insights into the inflationary environment and helps investors make informed decisions. By understanding the CPI YoY growth rate, investors can adjust their investment strategies to navigate the changing economic landscape and maximize their returns. Whether you are a seasoned investor or just starting out, keeping an eye on the CPI YoY growth rate can help you stay ahead of the curve and achieve your investment goals.Source: Investing.com