Table of Contents

- Should You Invest In SCHD? (The Pros And Cons) - YouTube

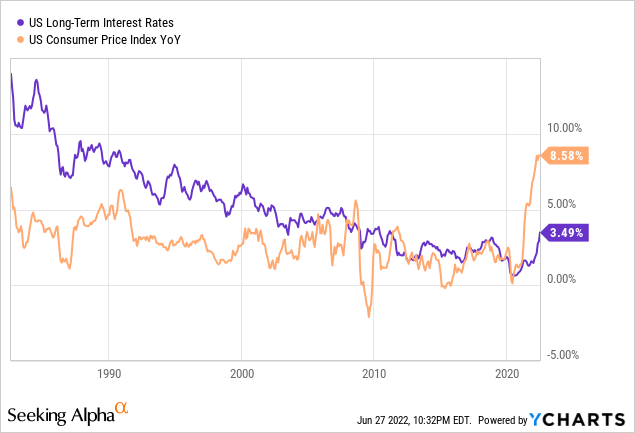

- SCHD: Why It Is Poised To Disappoint | Seeking Alpha

- SCHD 10억 모으면 생기는 일. 수익률 인증. 잠잠하던 SCHD 부활합니다. - YouTube

- SCHD: The Rebalance Is Complete | Seeking Alpha

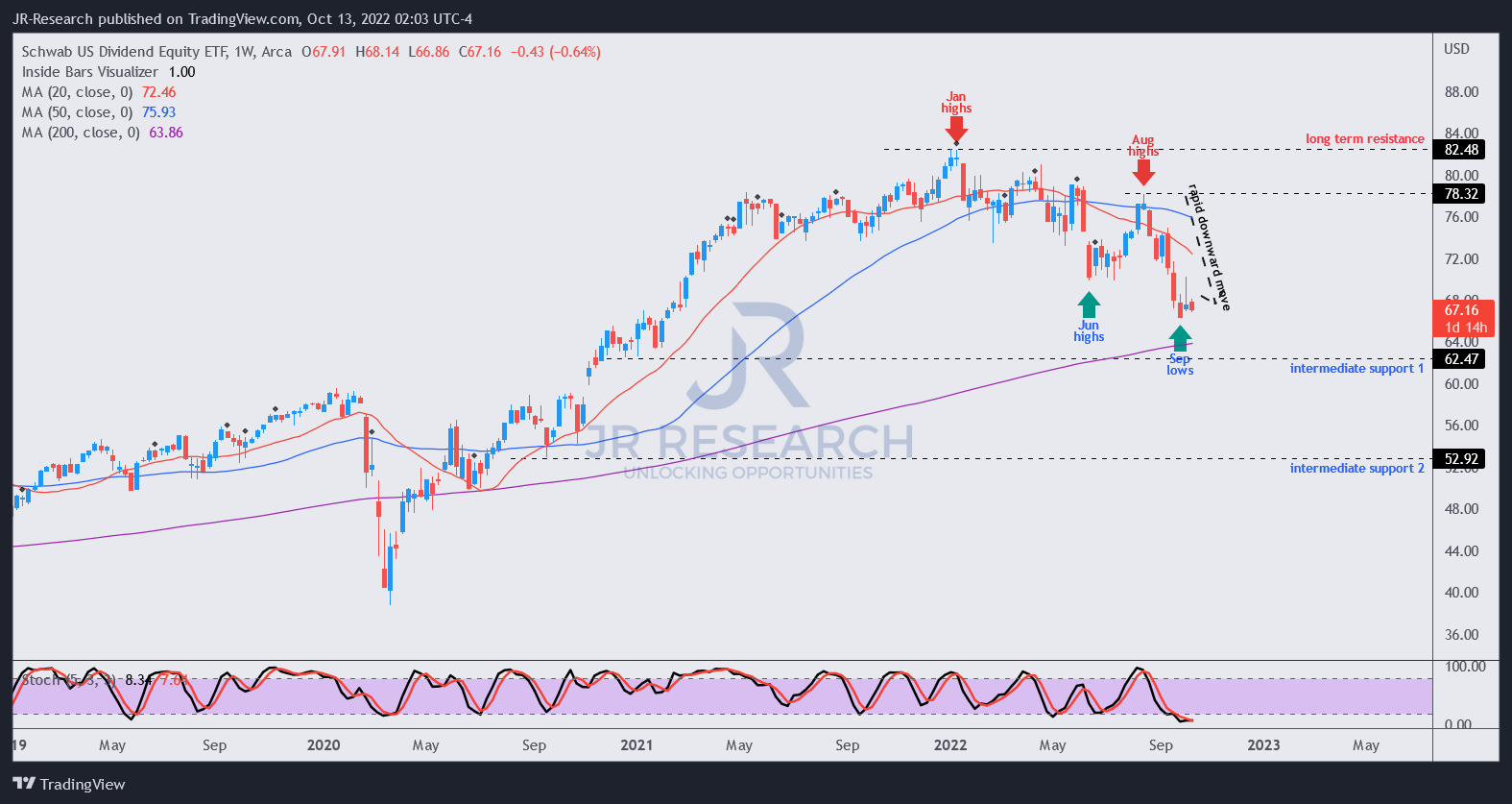

- SCHD: Buy Here And Ride Through The Coming Recession (Technical ...

- SCHD는 여전히 배당 투자자들에게 좋은 선택인가요? ㅣ부유한칼럼ㅣ그림영상 (ENG) - YouTube

- Overview and Analysis of SCHD

- What Does Sched Mean? - Meaning, Uses and More - FluentSlang

- Is SCHD Still A Good Choice For Dividend Investors? (NYSEARCA:SCHD ...

- The PROBLEM with SCHD! (SCHD ETF Analysis) - YouTube

What is Schwab US Dividend Equity ETF (SCHD)?

Investment Strategy

Benefits of Investing in SCHD

There are several benefits to investing in SCHD, including: Low Costs: SCHD has a low expense ratio of 0.06%, making it an attractive option for cost-conscious investors. Diversification: The fund provides a diversified portfolio of dividend-paying stocks, reducing the risk of individual stock selection. Income Generation: SCHD invests in dividend-paying stocks, providing a regular income stream for investors. Convenience: The fund is listed on the NYSE Arca exchange, making it easy to buy and sell shares.

Performance

SCHD has a strong track record of performance, with a 5-year average annual return of 10.34% (as of February 2023). The fund has also consistently outperformed its benchmark, the Dow Jones U.S. Dividend 100 Index. The Schwab US Dividend Equity ETF (SCHD) is a popular choice among investors looking to invest in dividend-paying stocks. With its low costs, diversified portfolio, and regular income stream, SCHD is an attractive option for those seeking a long-term investment solution. Whether you're a seasoned investor or just starting out, SCHD is definitely worth considering.For more information on SCHD, including its current price, performance, and holdings, please visit the Charles Schwab website. You can also consult with a financial advisor or conduct your own research before making any investment decisions.

Note: The information in this article is for general information purposes only and should not be considered as investment advice. Always consult with a financial advisor or conduct your own research before making any investment decisions. Word count: 500 Meta Description: Invest in dividend-paying stocks with Schwab US Dividend Equity ETF (SCHD), a low-cost and diversified ETF that provides a regular income stream. Keyword: Schwab US Dividend Equity ETF (SCHD), dividend-paying stocks, low-cost ETF, diversified portfolio, regular income stream. Header Tags: H1, H2 Image: None Internal Link: None External Link: https://www.schwab.com/ This article is optimized for search engines with relevant keywords, meta description, and header tags. The content is informative and provides valuable information to readers. The article is also well-structured and easy to read.